What Services Are Exempt From Sales Tax In Texas . Examples of data processing include the. While texas' sales tax generally applies to most transactions, certain items have special. Many services are subject to texas’s 6.25% state sales tax rate: twenty percent of the charge for data processing services is exempt from tax. what purchases are exempt from the texas sales tax? generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. are services subject to sales tax? are services subject to texas sales tax? certain nonprofit and governmental organizations may be exempt from paying sales tax, but they will need to apply for exemption from. While the texas sales tax of 6.25% applies to most transactions, there.

from www.formsbank.com

While the texas sales tax of 6.25% applies to most transactions, there. are services subject to texas sales tax? generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. are services subject to sales tax? twenty percent of the charge for data processing services is exempt from tax. While texas' sales tax generally applies to most transactions, certain items have special. Examples of data processing include the. certain nonprofit and governmental organizations may be exempt from paying sales tax, but they will need to apply for exemption from. what purchases are exempt from the texas sales tax? Many services are subject to texas’s 6.25% state sales tax rate:

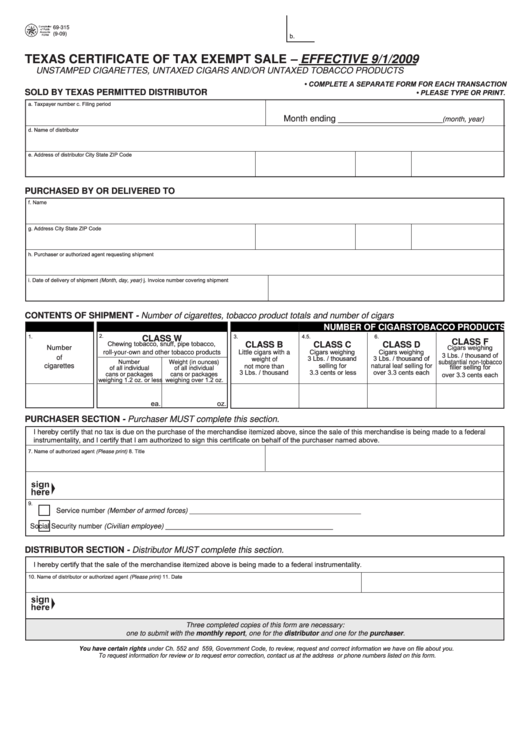

Fillable Form 69315 Texas Certificate Of Tax Exempt Sale printable pdf download

What Services Are Exempt From Sales Tax In Texas are services subject to sales tax? Many services are subject to texas’s 6.25% state sales tax rate: While texas' sales tax generally applies to most transactions, certain items have special. While the texas sales tax of 6.25% applies to most transactions, there. twenty percent of the charge for data processing services is exempt from tax. certain nonprofit and governmental organizations may be exempt from paying sales tax, but they will need to apply for exemption from. generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. Examples of data processing include the. what purchases are exempt from the texas sales tax? are services subject to texas sales tax? are services subject to sales tax?

From www.exemptform.com

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF What Services Are Exempt From Sales Tax In Texas what purchases are exempt from the texas sales tax? twenty percent of the charge for data processing services is exempt from tax. Examples of data processing include the. certain nonprofit and governmental organizations may be exempt from paying sales tax, but they will need to apply for exemption from. generally, exempt organizations must get a sales. What Services Are Exempt From Sales Tax In Texas.

From www.uslegalforms.com

Texas Tax Exempt Certificate Fill and Sign Printable Template Online US Legal Forms What Services Are Exempt From Sales Tax In Texas twenty percent of the charge for data processing services is exempt from tax. are services subject to texas sales tax? Many services are subject to texas’s 6.25% state sales tax rate: generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. what purchases are. What Services Are Exempt From Sales Tax In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Services Are Exempt From Sales Tax In Texas twenty percent of the charge for data processing services is exempt from tax. Many services are subject to texas’s 6.25% state sales tax rate: are services subject to sales tax? Examples of data processing include the. While texas' sales tax generally applies to most transactions, certain items have special. While the texas sales tax of 6.25% applies to. What Services Are Exempt From Sales Tax In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Services Are Exempt From Sales Tax In Texas generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. are services subject to texas sales tax? twenty percent of the charge for data processing services is exempt from tax. Many services are subject to texas’s 6.25% state sales tax rate: certain nonprofit and. What Services Are Exempt From Sales Tax In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Services Are Exempt From Sales Tax In Texas what purchases are exempt from the texas sales tax? are services subject to sales tax? While the texas sales tax of 6.25% applies to most transactions, there. While texas' sales tax generally applies to most transactions, certain items have special. Many services are subject to texas’s 6.25% state sales tax rate: certain nonprofit and governmental organizations may. What Services Are Exempt From Sales Tax In Texas.

From www.pdffiller.com

Fillable Online texas sales tax exemption form Fax Email Print pdfFiller What Services Are Exempt From Sales Tax In Texas are services subject to sales tax? While texas' sales tax generally applies to most transactions, certain items have special. what purchases are exempt from the texas sales tax? generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. Many services are subject to texas’s 6.25%. What Services Are Exempt From Sales Tax In Texas.

From www.exemptform.com

Texas Sales And Use Tax Exemption Form 01339 What Services Are Exempt From Sales Tax In Texas what purchases are exempt from the texas sales tax? generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. While texas' sales tax generally applies to most transactions, certain items have special. While the texas sales tax of 6.25% applies to most transactions, there. are. What Services Are Exempt From Sales Tax In Texas.

From digital.library.unt.edu

[Texas sales tax exemption certificate from the Texas Human Rights Foundation] UNT Digital Library What Services Are Exempt From Sales Tax In Texas twenty percent of the charge for data processing services is exempt from tax. Many services are subject to texas’s 6.25% state sales tax rate: what purchases are exempt from the texas sales tax? While the texas sales tax of 6.25% applies to most transactions, there. certain nonprofit and governmental organizations may be exempt from paying sales tax,. What Services Are Exempt From Sales Tax In Texas.

From www.exemptform.com

Texas Sales Tax Exemption Certificate Form What Services Are Exempt From Sales Tax In Texas While the texas sales tax of 6.25% applies to most transactions, there. are services subject to sales tax? what purchases are exempt from the texas sales tax? While texas' sales tax generally applies to most transactions, certain items have special. are services subject to texas sales tax? generally, exempt organizations must get a sales tax permit. What Services Are Exempt From Sales Tax In Texas.

From www.formsbank.com

Fillable Form 69302 Texas Certificate Of Tax Exempt Sale 2009 printable pdf download What Services Are Exempt From Sales Tax In Texas While texas' sales tax generally applies to most transactions, certain items have special. Examples of data processing include the. are services subject to texas sales tax? twenty percent of the charge for data processing services is exempt from tax. what purchases are exempt from the texas sales tax? are services subject to sales tax? While the. What Services Are Exempt From Sales Tax In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Services Are Exempt From Sales Tax In Texas certain nonprofit and governmental organizations may be exempt from paying sales tax, but they will need to apply for exemption from. what purchases are exempt from the texas sales tax? While the texas sales tax of 6.25% applies to most transactions, there. are services subject to sales tax? Examples of data processing include the. are services. What Services Are Exempt From Sales Tax In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Services Are Exempt From Sales Tax In Texas are services subject to sales tax? Examples of data processing include the. Many services are subject to texas’s 6.25% state sales tax rate: While texas' sales tax generally applies to most transactions, certain items have special. what purchases are exempt from the texas sales tax? twenty percent of the charge for data processing services is exempt from. What Services Are Exempt From Sales Tax In Texas.

From www.dochub.com

Tax exempt form texas Fill out & sign online DocHub What Services Are Exempt From Sales Tax In Texas twenty percent of the charge for data processing services is exempt from tax. While texas' sales tax generally applies to most transactions, certain items have special. certain nonprofit and governmental organizations may be exempt from paying sales tax, but they will need to apply for exemption from. Many services are subject to texas’s 6.25% state sales tax rate:. What Services Are Exempt From Sales Tax In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Services Are Exempt From Sales Tax In Texas are services subject to texas sales tax? While texas' sales tax generally applies to most transactions, certain items have special. are services subject to sales tax? what purchases are exempt from the texas sales tax? While the texas sales tax of 6.25% applies to most transactions, there. Many services are subject to texas’s 6.25% state sales tax. What Services Are Exempt From Sales Tax In Texas.

From blanker.org

Texas Sales and Use Tax Resale Certificate Forms Docs 2023 What Services Are Exempt From Sales Tax In Texas what purchases are exempt from the texas sales tax? are services subject to texas sales tax? Examples of data processing include the. generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. twenty percent of the charge for data processing services is exempt from. What Services Are Exempt From Sales Tax In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Services Are Exempt From Sales Tax In Texas what purchases are exempt from the texas sales tax? are services subject to sales tax? While the texas sales tax of 6.25% applies to most transactions, there. certain nonprofit and governmental organizations may be exempt from paying sales tax, but they will need to apply for exemption from. twenty percent of the charge for data processing. What Services Are Exempt From Sales Tax In Texas.

From mungfali.com

Texas Sales And Use Tax Exemption Blank Form What Services Are Exempt From Sales Tax In Texas twenty percent of the charge for data processing services is exempt from tax. are services subject to texas sales tax? what purchases are exempt from the texas sales tax? generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. Many services are subject to. What Services Are Exempt From Sales Tax In Texas.

From www.salestaxhandbook.com

Printable Texas Sales Tax Exemption Certificates What Services Are Exempt From Sales Tax In Texas what purchases are exempt from the texas sales tax? generally, exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they. are services subject to sales tax? certain nonprofit and governmental organizations may be exempt from paying sales tax, but they will need to apply for. What Services Are Exempt From Sales Tax In Texas.